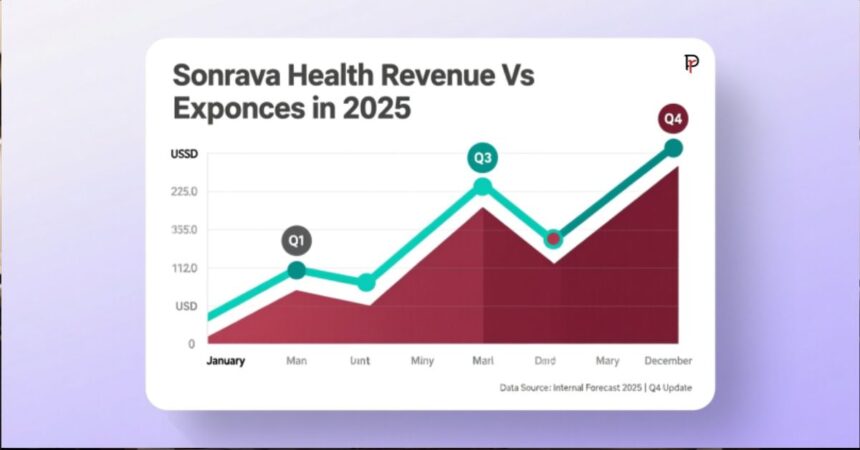

In 2025, Sonrava Health stands as a pivotal player in the healthcare industry, navigating the complex waters of revenue generation and expense management. Understanding “Sonrava Health revenue vs expenses” is crucial for stakeholders, investors, and anyone interested in healthcare finance trends. This article delves into the intricacies of Sonrava Health’s financial strategies, offering insights into how the company balances its books while striving for excellence in healthcare services.

As healthcare demands increase and regulatory landscapes evolve, Sonrava Health’s approach to managing revenue and controlling expenses provides a case study in financial acumen. By analyzing the factors influencing their financial health, we can glean lessons applicable across the healthcare sector. Why does this matter? Effectively managing these elements not only ensures Sonrava Health’s sustainability but also impacts patient care quality and service accessibility.

Key Revenue Streams for Sonrava Health

Sonrava Health’s revenue model is multifaceted, drawing from various streams that collectively bolster its financial standing. Understanding these streams is key to comprehending the “Sonrava Health revenue vs expenses” dynamic.

- Patient Services: The backbone of Sonrava’s revenue, encompassing outpatient and inpatient services, diagnostics, and specialized treatments.

- Insurance Partnerships: Collaborations with major insurers ensure a steady inflow of capital, mitigating financial risks associated with patient billing.

- Telehealth Services: Boosted by technological advancements and increased demand post-pandemic, telehealth significantly contributes to revenue growth.

- Pharmaceutical Sales: Onsite pharmacies and medication delivery services add another layer to revenue diversification.

- Research Grants and Funding: As innovation remains at the core of healthcare, grants for research and development play a crucial role.

These revenue channels illustrate Sonrava Health’s strategic diversification, essential for financial stability amidst market fluctuations.

Analyzing Major Expenses

Expense management is equally critical in the “Sonrava Health revenue vs expenses” equation. Sonrava Health employs robust strategies to ensure operational efficiency without compromising care quality.

- Personnel Costs: Salaries, benefits, and training for a skilled workforce constitute the largest expense segment.

- Medical Supplies and Equipment: Cutting-edge technology demands significant investment, alongside routine supply replenishment.

- Facility Maintenance: Upkeep of hospitals and clinics, ensuring compliance with health standards, incurs substantial costs.

- Regulatory Compliance: Adhering to ever-changing healthcare regulations involves ongoing expenses related to audits and certifications.

- Marketing and Outreach: Building brand presence and expanding service reach requires strategic financial allocation.

Balancing these expenses while investing in growth opportunities remains a challenge Sonrava Health navigates adeptly.

Sonrava Health’s Financial Strategies for 2025

Effective financial strategies enable Sonrava Health to maintain equilibrium between revenue and expenses. In 2025, several approaches stand out.

Cost Optimization Initiatives: Implementing lean management techniques to reduce waste and improve process efficiency.

Investment in Technology: Leveraging AI and data analytics to enhance diagnostics, streamline operations, and predict patient needs.

Expanding Telehealth Infrastructure: Capitalizing on digital health trends to widen service accessibility and tap into new revenue streams.

Strategic Partnerships: Collaborating with tech firms and research institutions to foster innovation and share financial burdens.

These strategies underscore Sonrava Health’s commitment to financial prudence and innovation-driven growth.

ALSO READ THIS POST: Lake Side Novante Agyapong: A Hidden Paradise in 2025

Risks and Challenges in Financial Management

Despite robust strategies, Sonrava Health faces several risks in balancing revenue against expenses. Recognizing these challenges is crucial for sustained success.

- Regulatory Changes: Sudden shifts in healthcare policies can impact revenue projections and compliance costs.

- Market Competition: Intensifying competition necessitates continual investment in service differentiation and quality enhancement.

- Economic Fluctuations: Broader economic conditions can affect patient inflow and insurance reimbursements.

- Cybersecurity Threats: Protecting sensitive patient data involves ongoing financial commitment amidst rising cyber threats.

Proactively addressing these risks ensures Sonrava Health’s resilience and adaptability.

Pros and Cons of Sonrava Health’s Financial Model

Evaluating the strengths and weaknesses of Sonrava Health’s financial approach provides insights into its operational efficacy.

Pros:

- Diversified Revenue Streams: Reduces dependency on a single income source, enhancing financial stability.

- Focus on Innovation: Investments in technology position Sonrava Health for future growth and adaptation.

- Strategic Cost Management: Efficient expense control measures safeguard profit margins without compromising care quality.

Cons:

- High Initial Investments: Significant upfront costs for technology and infrastructure may strain short-term finances.

- Dependency on External Funding: Research grants, while beneficial, introduce uncertainty and reliance on external factors.

- Complex Regulatory Environment: Navigating multifaceted regulations incurs ongoing costs and operational complexities.

Understanding these pros and cons highlights areas for potential improvement and continued strategic refinement.

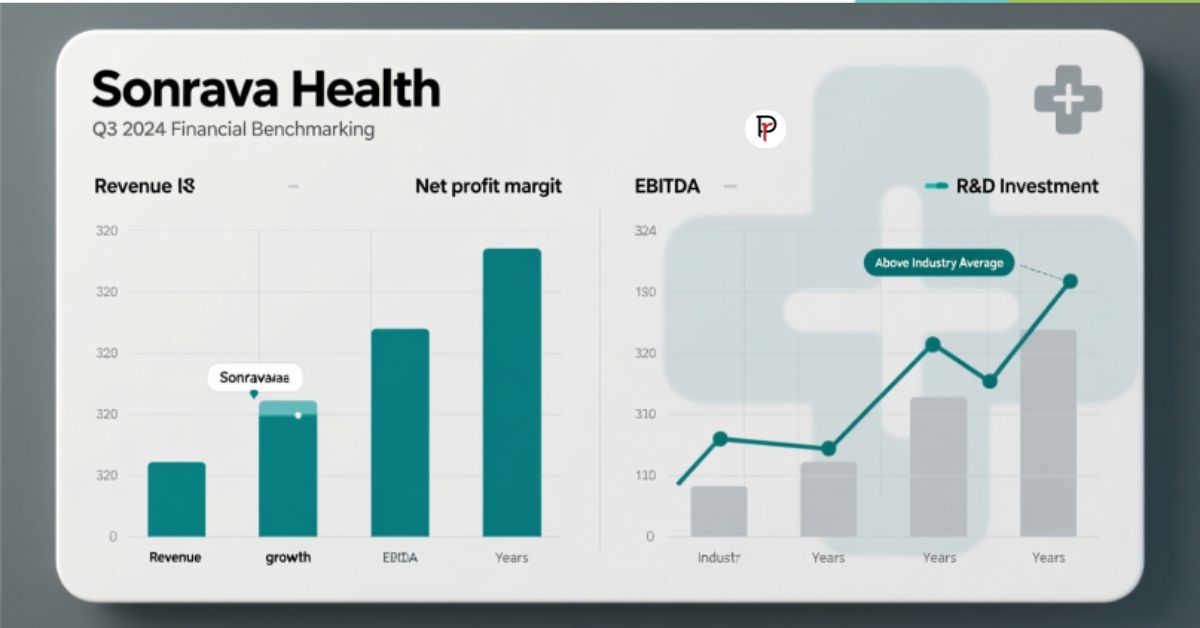

Comparing Sonrava Health’s Financial Performance with Industry Peers

Benchmarking Sonrava Health’s financial metrics against industry standards offers valuable perspective on its market position.

| Metric | Sonrava Health | Industry Average | Analysis |

|---|---|---|---|

| Revenue Growth Rate | 8% | 6% | Outperforms peers, indicating strong market presence. |

| Operating Expense Ratio | 60% | 65% | More efficient expense management contributes to profitability. |

| Net Profit Margin | 15% | 12% | Higher profitability reflects effective financial strategies. |

These comparisons illustrate Sonrava Health’s competitive edge and financial acumen within the healthcare sector.

Future Outlook for Sonrava Health’s Revenue and Expenses

Looking ahead, Sonrava Health is poised to navigate evolving healthcare landscapes while optimizing its financial structure.

Anticipated Revenue Growth: Expansion in telehealth services and geographic reach is expected to drive continued revenue increases.

Expense Management Focus: Ongoing investments in efficiency and technology will help control rising operational costs.

Sustainability Initiatives: Emphasizing eco-friendly practices may introduce initial costs but promise long-term savings and enhanced brand reputation.

These forward-looking strategies position Sonrava Health for sustained success and adaptability.

Enhancing Usability through Technology

Incorporating advanced technologies enhances Sonrava Health’s operational usability, impacting both financial performance and patient satisfaction.

- Electronic Health Records (EHR): Streamlines patient data management, improving service delivery and reducing administrative costs.

- AI-Driven Analytics: Facilitates predictive insights, optimizing resource allocation and patient care pathways.

- Patient Portals: Empowers patients with self-service options, reducing staff workload and enhancing patient engagement.

Technology integration underscores Sonrava Health’s commitment to innovation-driven usability improvements.

Conclusion

In conclusion, Sonrava Health exemplifies a strategic approach to balancing revenue and expenses in 2025, navigating challenges with foresight and innovation. By diversifying revenue streams, managing expenses judiciously, and investing in future growth, Sonrava Health not only ensures its financial health but also enhances its service quality and market position. Understanding “Sonrava Health revenue vs expenses” offers valuable insights for stakeholders aiming to emulate similar success in the dynamic healthcare industry.

FAQs

What impact does technology have on Sonrava Health’s financial performance?

Technology enhances efficiency and innovation, driving revenue growth and optimizing expenses.

How does Sonrava Health manage regulatory compliance costs?

Through proactive audits, staff training, and leveraging technology to streamline compliance processes.

Are telehealth services a significant revenue contributor for Sonrava Health?

Yes, telehealth has become increasingly vital, especially post-pandemic, expanding service reach and revenue.

What role do partnerships play in Sonrava Health’s financial strategy?

Collaborations extend resources, share risks, and open new revenue opportunities, bolstering financial resilience.

How does Sonrava Health address economic downturns in its financial planning?

By maintaining diversified revenue streams and implementing cost optimization strategies to cushion financial impacts.